Read Part 1 of Is it Really the Time to Buy?

Read Part 2 of Is it Really the Time to Buy?

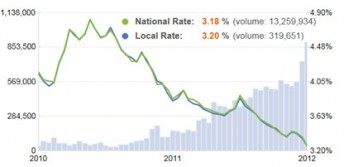

Mortgage Rates At Record Lows

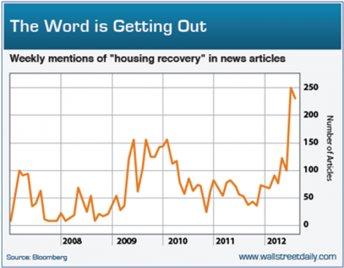

Mortgage rates are hitting record lows. The rates are at 3.4%.This is making a great impact in a way the economy has not seen since 2005. This is prompting a domino effect to allow many people to make the decision to purchase.

As of recently, the Feds are spending $40 billion a month purchasing money-backed securities. The Federal Reserve is looking to steer the economy in the right direction. The Feds purchase mortgage-backed securities to boost the economy. This is one of the ways to control economy turnaround.

The overall goal is to promote housing spending, as this is a key element to fix the economy. However, these mortgage rates are starting to rise.

“U.S. mortgage rates rose from record lows, increasing borrowing costs as an improving job market bolsters a recovery in housing.” Read the full story on Business Week

“The Fed’s move provided the financial support to the mortgage market and signaled an intention to keep rates low for the foreseeable future.”

Read the full story on CNN Money

“The nominal level of private residential construction spending has improved significantly over the past year, rising nearly 18% since last August and reaching its highest mark since early 2009.”

Read the full story on Eye on Housing

“Average U.S. rates on fixed mortgages fell again to new record lows. The decline suggests the Federal Reserve’s stimulus efforts may be having an impact on mortgage rates.”

Read the full story on NBC News

“The latest mortgage activity report published by the Mortgage Bankers Association (MBA) this morning shows record low mortgage rates are making an impact. The MBA’s data indicates average contracted rates dropped across varying types of mortgage loans last week, driving a surge in refinance activity. Such a change, while occurring simultaneously with a rise in housing prices, offers to lower the cost of housing on net for a great many people. The benefits of lowering the cost of living for Americans should theoretically include increased consumption.”