Today’s real estate market is just like any local, national, or international market. The U.S. residential housing market fluctuates due to combinations of industry and external factors. If you rent, this can make choosing the perfect time to buy your first home difficult if you’re trying to “align all the stars.”

Today’s real estate market is just like any local, national, or international market. The U.S. residential housing market fluctuates due to combinations of industry and external factors. If you rent, this can make choosing the perfect time to buy your first home difficult if you’re trying to “align all the stars.”

Sure, today’s residential real estate market can feel complicated with 7 percent mortgage interest rates, rising home prices, and an inflationary U.S. economy. Affordability is big for most people seeking to buy or build a new custom Florida home, and it’s often more important for first-time home buyers.

But today’s market is no more complicated than during the COVID-19 pandemic three years ago, when interest rates dipped below 3 percent, yet were tempered by the nation’s ongoing housing shortage, bidding wars, intense buyer competition, those rising home prices, and new construction homes being snapped up as soon as they were released for sale.

If you’re a renter who’s still unsure about buying, we at ICI Homes want to help you see that buying versus renting actually saves you money in the current residential real estate market.

Why now is the time

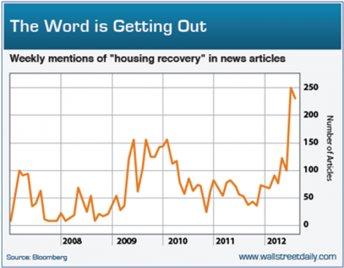

Remember those three-year-old headlines about home-buying urgency? Crazy bidding wars? People who bought homes unseen? That’s no longer common in today’s market.

But the demand for quality, affordable housing remains. To meet it, many builders now offer new construction incentives that help pay closing costs, buy down interest rates for a certain period, or grant design allowances on new builds. These incentives — which offset the effect of elevated interest rates, home prices and inflation — weren’t available three years ago.

Here’s another caution about delaying the purchase of your first home: each year you continue to rent, you lose time — another year of homeownership, of building equity in a valuable asset, and of paying down principal and the length of your mortgage.

You also lose a homestead exemption that mitigates property taxes, and an accompanying year-over-year cap on property taxes.

What you gain when you buy

Buying a home is an especially solid investment in an inflationary economy. Your monthly mortgage payments increase the equity, or value, in your home, which then becomes a fixed asset — something physical you own that’s financially invaluable.

Buying a home is an especially solid investment in an inflationary economy. Your monthly mortgage payments increase the equity, or value, in your home, which then becomes a fixed asset — something physical you own that’s financially invaluable.

You’re paying yourself (via a mortgage lender) to build equity rather than “throwing away” a couple thousand dollars you’ll never see again on monthly rent.

As an example, paying a $2,500 monthly rent for five years equals $150,000 of lost costs. Buying a $500,000 home with a 7 percent mortgage interest rate equals a 4 percent home valuation of $108,000 (an average of the three previous decades), plus $24,000 of paid-off principal after five years. You’re now $132,000 ahead.

It also offers another revenue stream— a home equity line of credit (HELOC) — if you like. And you’ll continue profiting by paying off principal and increasing your equity in years to come.

Are you ready for your new custom Florida home? Reach out to ICI Homes here to explore your options.

P.S. – Don’t forget to ask us for more information on our preferred lenders and special incentives available in your area!